Does a Company Need to Know if You Become Bankrupt

A bank is a financial institution which is involved in borrowing and lending money. Banks take client deposits in return for paying customers an annual interest payment. The depository financial institution and so uses the majority of these deposits to lend to other customers for a variety of loans. The divergence between the two interest rates is finer the profit margin for banks. Banks play an important role in the economy for offering a service for people wishing to save. Banks also play an important role in offering finance to businesses who wish to invest and expand. These loans and business investment are important for enabling economical growth.

Primary purpose of banks

- Keep coin safe for customers

- Offer customers interest on deposits, helping to protect confronting money losing value against inflation.

- Lending money to firms, customers and homebuyers.

- Offer financial communication and related financial services, such as insurance

1. Safety of deposits

Banks are seen as a secure place to deposit money. It would be impractical and risky to keep all your savings as cash under your bed. In medieval times, people would often pay early banks (due east.1000. Knights Templar) to go along their money and avails safe. It too saves people worrying about money. In the Uk, commercial banks are guaranteed by the Depository financial institution of England as a lender of last resort. Therefore, consumers encounter them as safe places to deposit coin.

2. Interest on deposits

Commercial banks pay interest on deposits. For current accounts, this may be very low, just for saving accounts, the interest rate can be significant. In a period of inflation, involvement rates on deposits are very important for maintaining the real value of your savings. For case, if inflation is iv% then keeping cash will come across the value of savings subtract in value. However, if the banking concern is paying an interest charge per unit of half dozen%, then the existent value of your savings will increase. For some customers, such as pensioners, interest payments on their banking concern savings can exist an important source of income.

Unlike types of Bank accounts

- Electric current account (checking account in the U.s.a.) This bank business relationship enables easy and quick access to money. A customer can withdraw the money at a moment's find and will accept features, such as debit card and greenbacks points. The interest rate on current account tends to be very low considering the bank needs to keep sufficient liquidity to run into the demand of customers to withdraw.

- Savings account (fourth dimension deposit account) Savings accounts typically have limits on the amount of money that tin exist withdrawn at once. Often banks require a certain observe of (due east.grand. 7 days) to pay money requested. This enables banks to pay a higher interest rate as the bank needs less liquidity.

3. Loans

A depository financial institution can get more profitable by using a per centum of its deposits to lend to other customers. If a bank pays two% on depository financial institution deposits merely lends money to firms and consumers at vi%, then it can make a bigger profit on its deposits. A bank but needs to keep sufficient liquidity to encounter the demands of customers to withdraw money.

Different types of bank lending

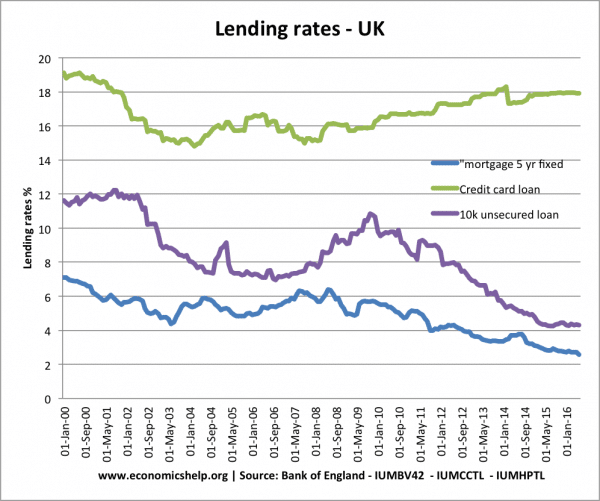

Bank lending varies from unsecured personal loans to secured mortgage lending. Unsecured lending tends to be at a higher interest rate considering of the adventure factor. Secured mortgage lending is at a lower rate, but can be over thirty years or more.

- Personal loan – In this example, the bank may brand a loan to exist paid back over a few years. This loan may exist unsecured against whatsoever assets like a house. Personal loans could be for a big purchase like a auto or specifically to assistance fund a career or educational improvement.

- Business loan – A loan for a firm to invest and expand their business organisation.

- Mortgage – This is a special type of loan, where the bank advances a loan to buy a firm. Usually, the client will need to pay a deposit on the house, east.yard. 10% of the loan. The bank legally owns the firm until the borrowers accept finished paying back the mortgage payments over a flow of 20-xl years. Interest rates on mortgages tend to exist relatively low considering the loan is secured against the value of the house. However, on a 30-yr mortgages, home-buyers will typically pay more than involvement than the full cost of the firm.

- Overdraft. A banking company tin can concur on an overdraft with customers. This allows them to borrow coin in the curt term speedily and conveniently. However, the amount immune tends to be quite modest.

4. Other features

Banks can as well give other features to consumers, such every bit:

- Instant access to cash (pigsty in the wall cash machines)

- Advice on financial matters

- Methods to make international payments. Increasingly banks offering electronic transfer of money through systems such as BACS

- Offering special offers to customers, including arranging travel insurance. Increasingly many electric current accounts come up with a range of extras, such as costless travel insurance, free membership of the AA

Banking in the United kingdom is a very assisting enterprise because in that location is a lack of contest. The market is dominated by the summit 10 banks and in item the big 5 banks.

Evaluation of the office and purpose of banking

- Loans are essentials to enable firms to invest and expand. However, banks are not the only source of finance. Firms may turn to private investors, stockmarket, government grants or personal savings.

- In times of recession or shortage of funds, banks may not be willing to lend when firms need it most.

- Banking concern lending is profitable for banks and tin incur pregnant costs for the firm.

- Consumers increasingly need banks to pay for bills electronically.

- Banking concern loans and mortgages provide an opportunity to buy very expensive items and pay back over a long period – e.thou. house, car.

- The poorest consumers often don't have admission to bank account and bank loans, causing the poorest to await exterior traditional banking to more than exploitative loans, such as payday loans and money sharks.

- Some insurance services are non necessary, for example, insuring electronic appurtenances is expensive compared to the cost of replacing them.

- Low-income consumers may feel they cannot afford insurance payments and put themselves at chance.

Different aspects of the cyberbanking system

- Loftier Street Banks providing services to the general public. In the UK The Big Five banks are HSBC, Halifax, Lloyds TSB, Natwest and Brotherhood & Leicester.

- Business Cyberbanking. Many high street banks provide specialised services for businesses. They operate similar to ordinary accounts but normally have more services and more than fees.

- Investment Cyberbanking. These are financial institutions who invest money on behalf of investment trusts, pension funds and high street Banks. They look for the all-time way to invest coin through knowledge of dissimilar bond markets, commutation rate markets and the stock market.

- Primal Banks. Underpinning most modernistic banking systems is the Fundamental Banking company. Usually a quasi-regime organization, Central Banks have various tasks such as ensuring sufficient liquidity, interim as lender of final resort and in some cases setting Budgetary Policy. In the UK, The Depository financial institution of England is responsible for Monetary Policy.

Banking Organisation Stability and Collapse

- The aim of the cyberbanking system is to provide security and conviction in the economic system. If banks were immune to go bankrupt and consumers lost savings; information technology would cause widespread financial panic and many consumers would withdraw their savings and hold equally cash. If in that location was a withdrawal of money it would cause a shortage of funds for lending. This is why Central banks act as lender of last resort.

Related

- Policies to increase banking company lending

- Pinnacle ten British Banks

- The function of a central bank

You can read more at our privacy page, where you can change preferences whenever you wish.

christensenaladvid.blogspot.com

Source: https://www.economicshelp.org/blog/glossary/banks/

0 Response to "Does a Company Need to Know if You Become Bankrupt"

Post a Comment